Self-Service Portal

At Freedom Mortgage, I led strategy, research, and design for a self-service mortgage experience that improved user clarity and reduced friction across the loan journey. By redesigning the application and integrating proactive refinance tools, we generated $9.2M in revenue, cut call times by 50%, accelerated loan closures, and strengthened competitiveness against digital-first lenders like Rocket Mortgage.

Success Metrics

Defined and tracked performance across three key performance indicators:

Loan Process Efficiency

Goal: Reduce average mortgage closing time by 20% within 12 months.

Metric: Track days from application to closing, including approval stages and stakeholder involvement.

Tools: Google Analytics to monitor engagement and conversion behavior.

Operational Streamlining

Goal: Reduce call time during mortgage applications by 25% in 6 months, 50% in 12 months.

Metric: Measure staff involvement and average call duration post–self-service implementation.

Tools: DialogTech for call analytics.

Expected Outcome: Fewer employee errors and faster loan closures.

User Experience

Goal: Improve user control and transparency throughout the mortgage process.

Approach: Ongoing qualitative research, continuous discovery, and Qualtrics surveys.

Metrics & Targets:

User Transparency Satisfaction: 4.0

User Control Score: 4.0

Key Self-Service Actions: Enabled and tracked

Time to Complete Mortgage Online: Under 20 minutes

Design Opportunity

User Problem

The majority (80%) of borrowers preferred digital self-service over talking to a loan officer, yet Freedom Mortgage’s experience relied heavily on time-consuming phone calls and outdated processes.

This led to:

Missed expectations for tech-savvy customers (especially millennials)

Lost business to modern competitors like Better.com

Business Problem

Executives needed proof that self-service could deliver strong ROI. Despite skepticism, the business agreed to a "test-and-learn" approach to explore:

Whether users would complete mortgages online

How digital engagement could complement call center workflows

What level of investment was warranted

Team Structure & Collaboration

This initiative required executive buy-in, deep technical partnership, and strategic alignment across marketing, product, operations, and call center leadership. As the Sr. Director of XD and Research, I led both the design vision and team formation—partnering with cross-functional stakeholders to scale a single feature into an enterprise-wide experience strategy.

Core Team

Sr. Director of XD and Research - (my role)

VP of Digital Marketing

VP of Customer Experience

Frontline Development Team

SVP of Digital Marketing

SVP of Product

Key Stakeholders

Call Center - Streamline Team

EVP of Call Center

SVP of Data Marketing

Chief Knowledge Officer

Chief Marketing Officer

Chief Product Officer

Chief Executive Officer

Socialized Teams

Call Center - Shark Tank

SVP Back Office

Back End Architecture Teams

Product Teams

Key Decisions & Process

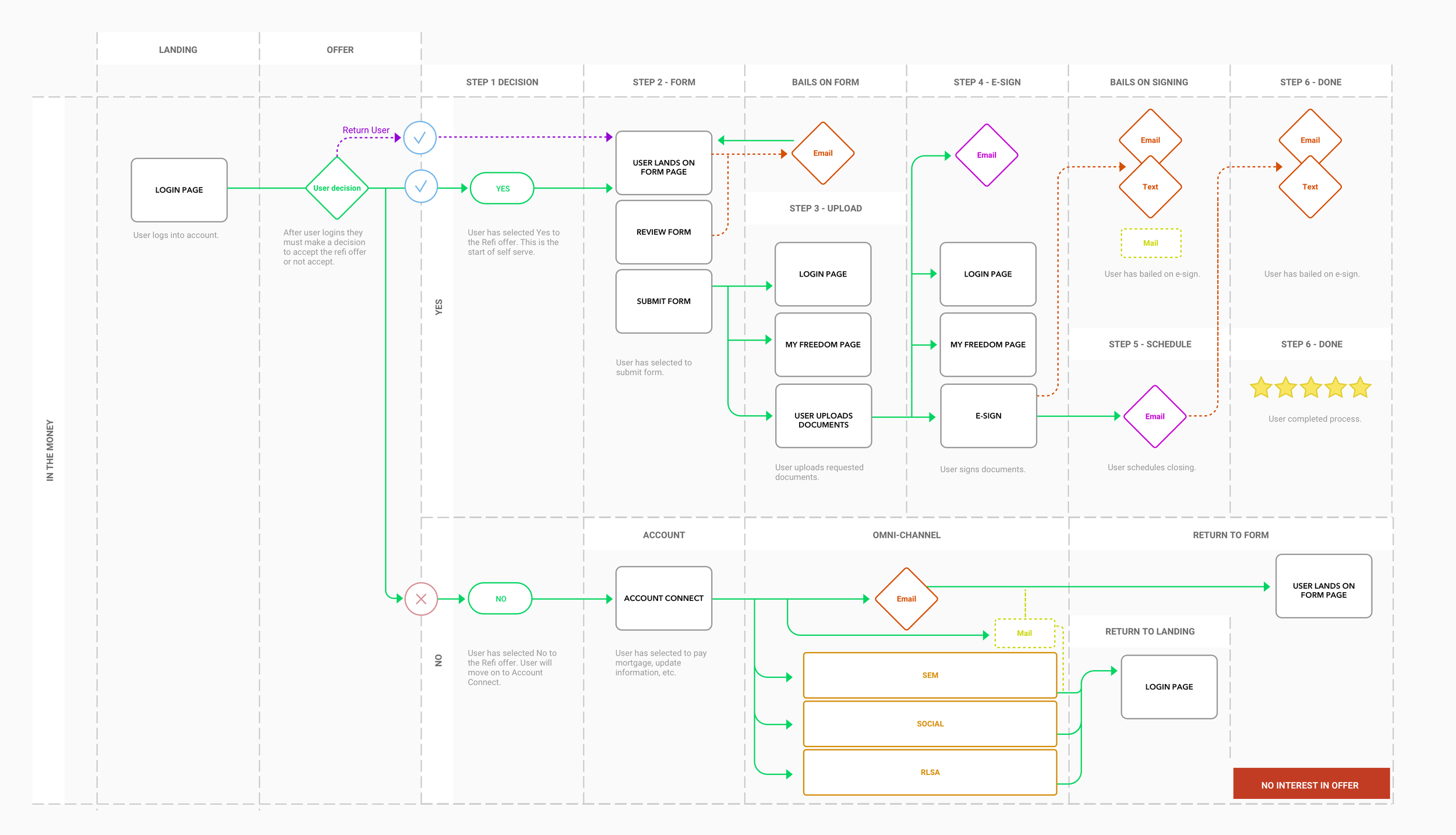

Create and Test a Proactive Self-Service Swimlane

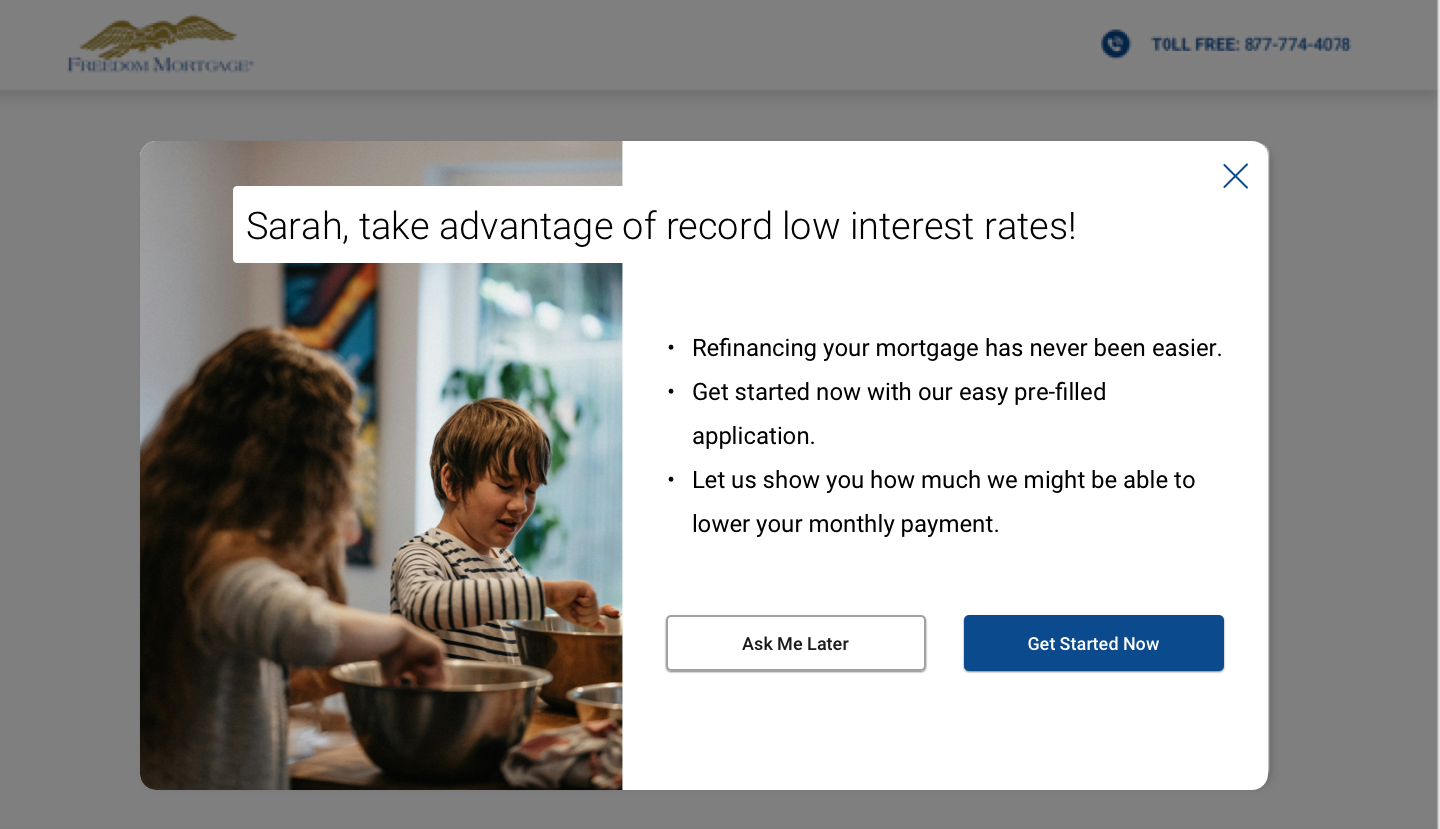

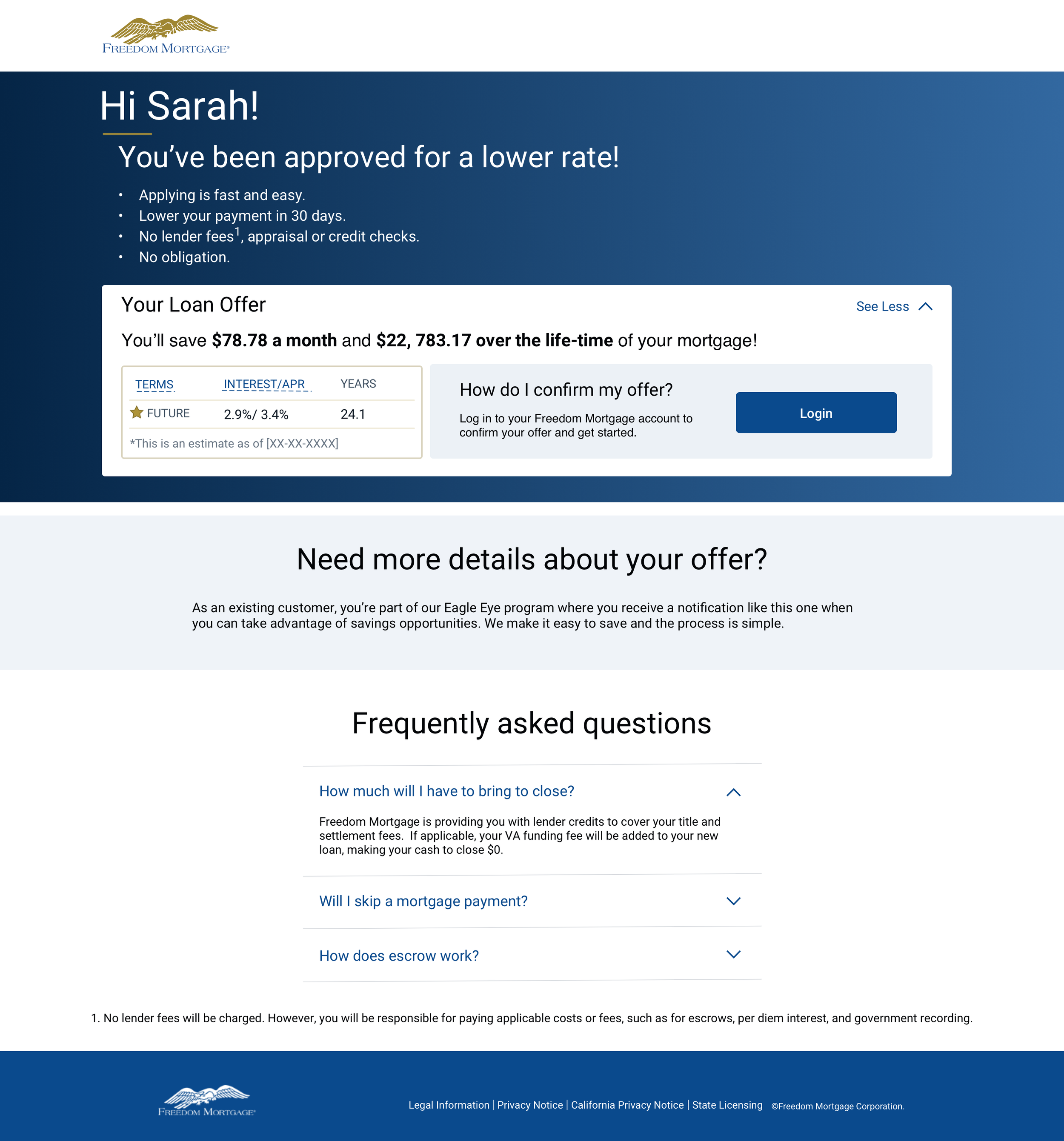

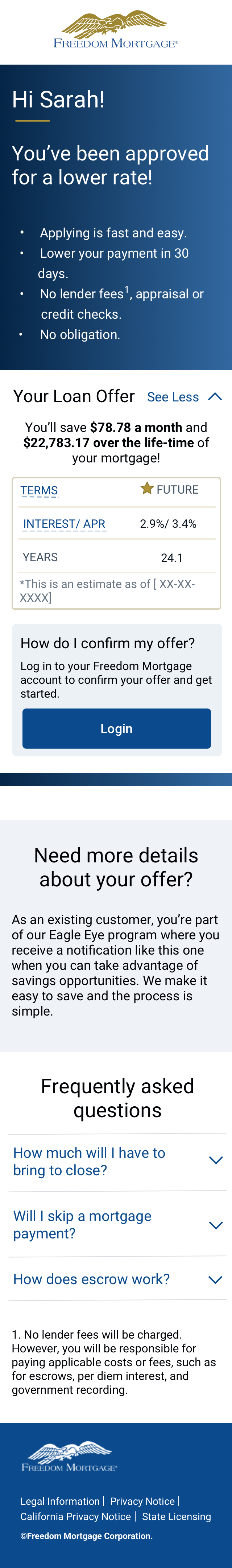

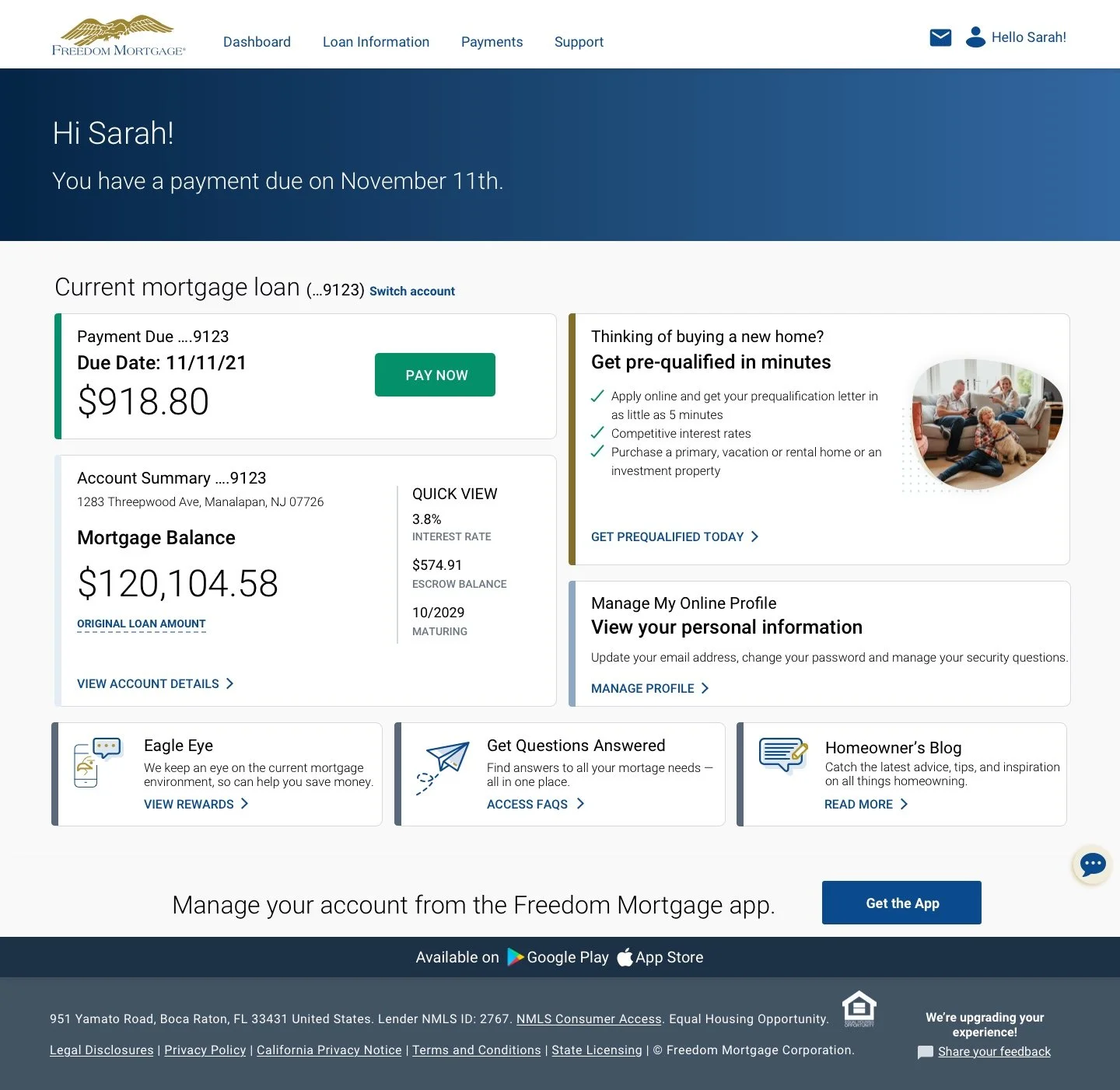

I led the creation of a new self-service swimlane to address user confusion caused by being dropped into a refinance flow when simply trying to make a mortgage payment. As an initial intervention, I designed a modal to clarify intent and guide users down the appropriate paths. I then developed a targeted email campaign that directed users to personalized landing pages showing their refinance offers.

This streamlined approach generated $1.8M in revenue, doubling the modal test’s results in just 8% of the time. The impact captured C-suite attention and led to deeper cross-functional alignment and investment in expanding the design function.

Modal after logging in to account

Strategic decision tree developed to align messaging with the most effective communication channels

Targeted Email Campaign Driving to Personalized Offer

Personalized Offer

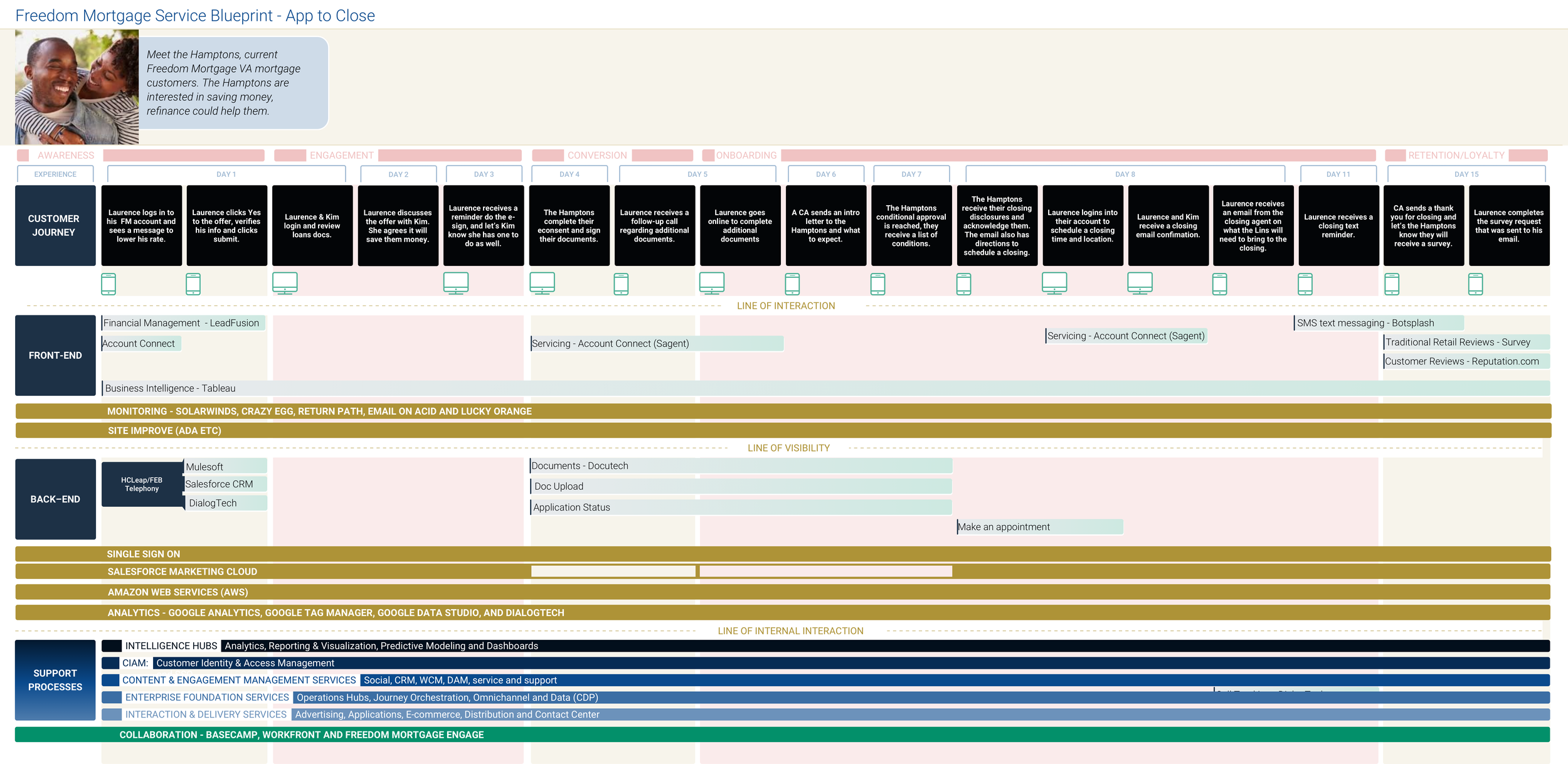

Operationalizing Strategy Through Service Design

To bridge fragmented systems and align executive stakeholders, I led the development of a comprehensive service blueprint that mapped the end-to-end mortgage experience.

This artifact became a strategic tool that:

Surfaced critical experience gaps and backend inefficiencies impacting both users and internal teams

Facilitated cross-functional alignment by making invisible service layers visible to product, ops, and tech stakeholders

Enabled design-led prioritization, helping leadership make informed decisions about resourcing, sequencing, and future investments

Future-State Service Blueprint Aligning Cross-Functional Vision

Redesign the Refinance Application

I led UX research, design, and A/B testing for the VA refinance application, which became the blueprint for all mortgage types across the organization. This initiative marked the company’s first fully online mortgage experience.

Results:

Drove $2.4M in revenue in the first month

Increased digital application volume and reduced call center dependency

Secured funding to scale design, adding 4 product designers, a UX researcher, and a visual designer

Scaling Experience Design Through Data-Driven Leadership

With marketing campaigns driving volume to the new VA application, I partnered with our UX researcher to identify friction points within the customer account portal through moderated and unmoderated research studies, journey mapping, and competitive analysis. As new hires from industry leaders like Mr. Cooper and Wells Fargo joined the team, I embedded continuous user research into the product lifecycle—mitigating internal bias and aligning product strategy with real user needs.

As the first designer and researcher on the initiative, I led concept development across the mortgage application, marketing touchpoints, and the self-service portal. Strong testing results and measurable impact secured stakeholder investment, allowing me to scale the team to 20, including four new designers and a roadmap for a conversational design swimlane.

Business Impact:

Delivered $9.2M in revenue by year-end

Expanded the design function to support enterprise-level growth

Built a repeatable framework aligning product vision, UX strategy, and business outcomes

Self-Service Portal

Learnings

Build Trust with Clear, Contextual Guidance

Early prototypes that lacked transparency failed to convert. Small changes, like a user-controlled modal—restored clarity and trust.

Service Design Drives Strategy

The blueprint wasn’t just a design artifact—it became a strategic tool that aligned leadership, guided staffing, and informed business planning.

Quantify to Justify

Revenue and efficiency wins gave design a seat at the table. Data-backed results convinced the C-suite to invest in a new team and platform.

Design Lead Transformation

What began as a design sprint became a catalyst for broader transformation, scaling from one feature to a 6-person experience team and a dedicated conversational design initiative.

Explore More Case Studies

Driving Business Outcomes Through Leadership

From personalization and GPS-based experiences to extended reality (XR) and enterprise-scale ecosystems, each case study highlights a unique facet of how I lead research, strategy, and user-centered solutions that drive meaningful impact.